Contractor Insurance

The contracting / construction industry comes with its own trials and tribulations. Our online Contractor Insurance program allows you to obtain an instant quote in the web browser that’s custom fit to your business. Apply now and get insured in minutes!

- Instant online quotes

- Electronic policy documents

- Choose your coverage

- Automated renewal reminders

- Reliable underwriters

- Next day coverage

Commercial General Liability (CGL)

Commercial General Liability (CGL) for your business operations in the event you are held liable for third party property damage or bodily injury.

Tools & Contractor Equipment

Property coverage for the relevant tools & equipment for your class of contracting. Protect the items that enable you to perform your business operations.

Office Contents / Business Property

This protects your company assets located inside your place of business that are damaged by an insured peril. This can include things like computers, printers, furniture, etc.

More Coverages Available

Choose to include the insurance that matters to your business such as Cyber / Data Coverage, Legal Expense Insurance, Installation Floater, and more.

How It Works

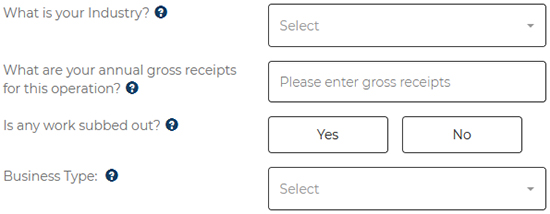

Provide some basic info about your contracting business.

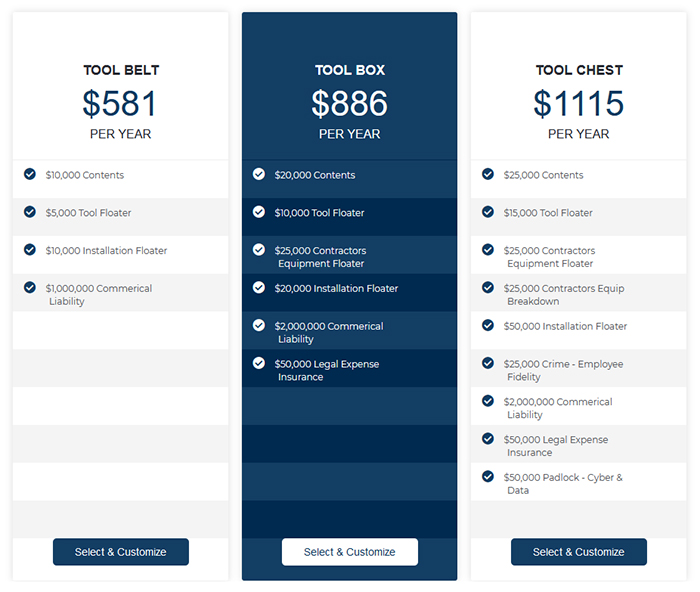

Compare, customize, and select your contractors insurance package.

Get to work knowing you have adequate insurance coverage.

Learn more about Contractors Insurance

What is Contractor Insurance?

There are various types of coverage available for your operations as a contractor in the construction industry and we’re here to help determine which are best for your company. Select policy limits based on industry requirements from $1,000,000 – $5,000,000 + and only pay for the coverage you need. Here are some common coverage types available through our Contractor Insurance program:

Commercial General Liability (CGL) – This is a primary coverage for many types of contractors and almost always an essential part of your commercial insurance package. The policy will protect an organization against liability claims for bodily injury (BI) and property damage (PD) arising out of business operations, premises, products, and completed ops.

Professional Liability (E&O) – Also called Errors & Omissions Insurance; this type of coverage is important for some types businesses as well. The policy protects a person or organization against liability claims arising from professional services rendered in your course of operations. This product is available when requested for contractors, but is not typical unless there is design work or controller programming being performed.

Commercial / Business Property (Tools, Equipment, Buildings, etc.) – The equipment you use on a daily basis for your work are important assets to have insured. You may also have office contents, tools, equipment, and other types of property to include in your coverage for a contractors insurance policy. We can help with that!

More Coverage Options – there are many other forms of coverage available for contractor insurance policies including: Installation Floater, Aviation Liability, Fidelity Bond / Employee Crime Coverage, Cyber Liability, and more. Don’t hesitate to let us know if you’d like a coverage included in your policy that is not listed here and not available through our automated digital quoting system.

What types of contractors can be insured?

As a contractor, it’s important to obtain the insurance that is relevant to the type of work you are performing. Some types of contracting operations that we can protect with a policy include, but are not limited to:

Why do I need insurance as a contractor?

Damages arising out of liability claims can be costly. We’ll arrange a policy that shields you and your company from various perils that could affect the well-being of your contracting business. Being held liable for a large 3rd party property or bodily injury loss can be devastating. Our reliable insurers provide coverage for out-of-court settlements, litigation, and judgements awarded by the courts for damages caused by negligence.

Obtain the protection you need with our general liability insurance for contractors program and ensure your business is covered by clicking the Quote & Buy Now button above.

How much does Contractor Insurance cost?

The cost of your contractor insurance policy will depend on certain variable that are specific to your business. These can include:

- Type of work performed

- Other operation specifics

- Annual revenues

- Number of employees

- Specified coverages

- Deductibles

- Loss history

- and more

We are able to offer terms with competitive premiums for annual coverage with coverage you can count on.

Don’t worry! Completing our online application does not cost anything or have an obligation to proceed with the coverage once a quote is provided – customer service is our first priority.

Popular Contractor Insurance Classes

Terminology of Contractor Insurance

Sometimes the insurance for a contracting business may be referred to as “Subcontractor Insurance”. In essence, this is no different than the contractor insurance package that we offer – whether you are operating as a sub to a general, or forming your own business relationships directly with your clients. The same kinds of insurance are applicable and we almost always recommend Commercial General Liability (CGL) as the foundation for good risk management for contractors.

If you’re unable to find your class of business through our contractor insurance application, don’t hesitate to contact us to discuss potential coverage for your business operations.

If you’re an independent contractor working in the construction field, you’ve come to the right place! You can select and review the specific kinds of coverage you’ll need in order to obtain Independent Contractor Liability Insurance.

Working independently doesn’t necessarily mean that you don’t have employees. During your online application process we’ll ask to confirm if you have any personnel working under your company name or if you’re a one-man-show. Get a free quote today.

Construction Liability Insurance can refer to various forms of coverage in the insurance industry. If you’re working as a contractor in the construction field, this policy is for you!

Should you be looking for alternate forms of construction insurance such as materials and structural protection for the duration of a project then check out our Course of Construction / Builders Risk page for more information.

The term Contractual Liability references liability that one party has assumed on behalf of another by means of a contract. This is a form of coverage commonly included in commercial insurance policies.

Our Underwriters

What Our Clients Say