Renters Insurance

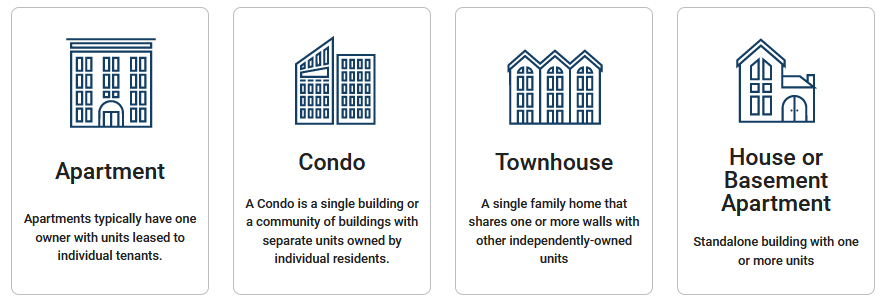

Whether you’re renting an apartment, condo, or house; your landlord’s insurance does not cover your liability or property in the event of a loss. Renters Insurance, also called Tenants Insurance, covers your contents, personal liability, potential additional living expenses, and more. Get a free quote online today!

- Instant online quotes

- Monthly payment options

- Electronic policy documents

- Select the coverage that matters to you

- Automated renewal reminders

- Reliable underwriters

- Next day coverage

Your Contents

Choose to insure the things you care about including televisions, furniture, non-built in appliances, clothing, and more.

Your Liability

Personal liability protection covers you worldwide for third party property damage (PD) or bodily injury (BI) claims.

Additional Living Expenses

If you're unable to live in your rented property due to an insured loss, your extra living expenses are covered by Underwriters.

Other Coverage Extensions

Select the coverage that fits your lifestyle such as sewer back-up and more.

How It Works

Provide some basic info about yourself and your rental.

Get an instant quote in the web browser that you can customize & purchase.

Get immediate access to your renters insurance policy digitally.

Frequently Asked Questions

What is Renters Insurance?

We offer affordable, uniquely tailored Renters Insurance packages that fit your lifestyle. Tenants Insurance keeps your things safe and provides defense costs for certain lawsuits brought against you. We provide coverage from industry standardized perils for home & condo renters.

What's covered by Renters / Tenants Insurance?

Your Belongings – Personal property coverage protects your belongings should they be damaged or while on vacation anywhere in the world as a result of an insured peril.

Yourself – Liability coverage protects you financially in the event that you are held legally liable for damages as a result of bodily injury; and property damage caused to your rental property or the property of others (common limits of $1,000,000 or $2,000,000 are both available).

Additional Living Expenses – Should your rental property be unlivable due to an insured loss. Our Underwriters will help get you back on your feet with 30 days of living expense coverage which will ensure you’ve got a roof over your head.

Which perils are insured by Renters Insurance?

Standard perils such as fire and theft are common risks covered by renters policies; however, there’s also excess coverage available with our renters insurance program. You can select options like sewer back-up for extended policy wordings. Allow our easy-to-use application process walk you through what you’d like to insure by clicking get a quote today.

Why do I need Renters Insurance?

In the event that your apartment/home and/or its contents suffer a substantial loss, it’s important that you’re protected. With the payment of your deductible (commonly between $500 and $1,000), you’ll have your property replaced that was lost. Personal liability will also cover potential damages, including legal defense costs, for occurences where you may be found legally liable.

How much does Renters Insurance cost?

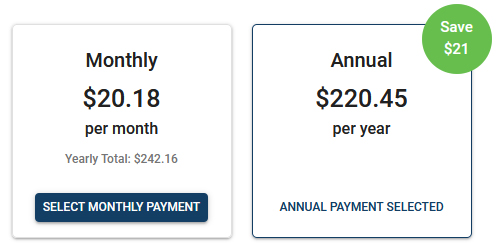

The cost of your Renters Insurance policy will depend on certain variables including your age, your rental properties age, construction type, coverage limits, and deductibles requested. We are able to offer terms with premiums as low as $219 for annual coverage.

Don’t worry! Completing our online application does not cost anything or have an obligation to proceed with the coverage once a quote is provided – customer service is our first priority.

Related Articles

Minimizing Risk: Why Landlords Should Require Tenants Insurance

If you’re renting out your condo, home, basement suite, or property of any type; you may assume your current insurance policy would cover anything that could happen to your property.

Our Underwriters

What Our Clients Say