Landscaping Insurance

Ensure you and your business are covered with our specially tailored Landscaping Insurance package. Cover the things that matter to your business such as your commercial liability and tools / equipment. Click ‘Get a Quote‘ today and let us do the shopping for you.

- Instant online quotes

- Electronic policy documents

- Choose your coverage

- Automated renewal reminders

- Reliable underwriters

- Next day coverage

Commercial General Liability (CGL)

Commercial General Liability (CGL) for your business operations in the event you are held liable for third party property damage or bodily injury.

Tools & Contractor Equipment

Property coverage for your business tools ,equipment, and even office contents such as: mowers, diggers, hedge trimmers, computers, and more.

Office Contents / Business Property

If you're unable to live in your rented property due to an insured loss, your extra living expenses are covered by Underwriters.

More Coverages Available

Select the coverage that fits your lifestyle such as sewer back-up, earthquake, and more.

How It Works

Provide some basic info about your business.

Compare and select your insurance coverage.

Get to work knowing your business is insured.

Learn more about Insurance for Landscape Contractors

What's included in Landscaping Insurance?

We review your application details to determine the insurance package that’s best for your business operations; however, there are some coverages, such as Commercial General Liability (CGL), that are essential for your landscaping business. This will ensure you and your company are protected against liability claims for bodily injury (BI) and property damage (PD) arising out of premises, operations, product, and completed operations. Standard limits of a CGL policy for a landscaper range from $1,000,000 to $5,000,000 + depending on operating specifics and requirements.

Another common form of coverage we offer for landscapers is insurance for your Tools and Equipment such as leaf blowers, shovels, lawn mowers, and more. Should you require other forms of risk mitigation such as Errors & Omissions (E&O) or an Installation Floater, we can help with that too!

Why do I need Landscaping Insurance?

It’s important to cover your commercial equipment and tools that can be worth thousands, or tens of thousands of dollars, but damages arising from liability claims can be quite a bit more costly. We’ll arrange a policy that shield you and your company from not only bodily injury and property damage claims, but the expenses of out-of-court settlements, litigation, and judgements awarded by the courts as well. If damages are filed against your organization or you are sued, our reliable insurers will cover the costs for investigation, attorney expenses, medical expenses in the case of injury, and potential court ruled payouts.

Operations that can be a part of your Landscaping Insurance package include:

- Garden & Lawn Maintenance

- Landscape Renovations

- Lawn Installations & Repairs

- Paving Stone Installations

- Pruning & Planting

- Pressure Washing

- and more

Not only are you insuring your liability with this package, but often times project owners (such as municipalities and general contractors) will require you to name them as “Additional Insured” on your policy in order to perform work for them. This option is provided at no additional cost through Netsurance Canada when you hold a policy through us. If you’d like to review the Government of Canada start-up checklist for landscaping and snow removal businesses, you can check it out here. There are some great insights on starting a new landscaping venture.

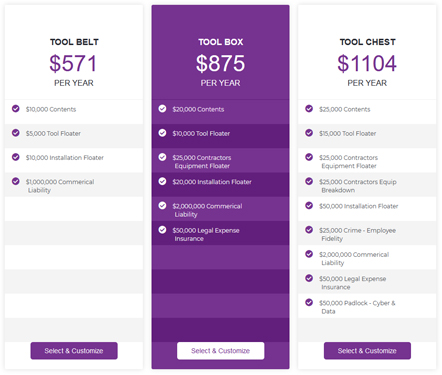

How much does Landscaping Insurance cost?

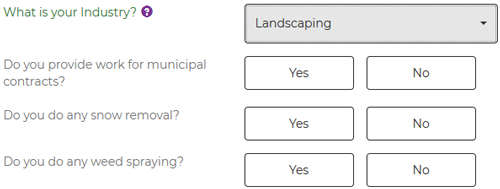

Your Landscaping Insurance quote will depend on specific variables that are part of our application process including:

- Complete List of Operations

- Annual Revenues

- Number of Employees

- Specified Coverages & Limits

- Deductibles

- and more

We are able to offer insurance terms with premiums as low as $525 for annual coverage. Don’t worry! Completing our online application doesn’t cost anything or require you to proceed with coverage once a quote is provided – customer services is our first priority.

Video Transcript

Just like many businesses, landscaping companies are exposed to risks that can lead to an accident or financial loss. A mistake while on a job site that causes third party property damage or bodily injury; or the theft of your tools can be quite costly.

Landscaping Insurance will protect you and your business from the potential damages that can result from these risks. A few examples of common coverages for Landscaping Insurance include: Commercial General Liability and Tools & Equipment Coverage.

You want to ensure your business has adequate insurance. So, how much does Landscaping Insurance Cost? That depends on a few variables that are a part of our free online application process. There’s no cost and no obligation – click get a quote today.

Related Articles

Starting a Landscaping Business this Spring? Don’t Forget Insurance!

As the Winter months run their course and Spring approaches, lawn care and general landscaping are desired services by homeowners and stratas alike. If you’re an experienced landscaper starting your

Our Underwriters

What Our Clients Say