Special Event Insurance

Special Event Insurance (also called Event Liability) provides liability coverage for third party property damage and bodily injury that could occur at your event. We can also include Liquor Liability if alcohol is being served at your event. Get a quote and purchase coverage online today!

- Instant online quotes

- Electronic policy documents

- Reliable underwriters

- Liquor / alcohol liability

- All types of events

General Liability

Commercial General Liability (CGL) covers the event host from third party property damage (PD) or bodily injury (BI) claims.

Liquor Liability

If required, we provide Host Liquor Liability for your event which extends to the venue when added as an additional insured.

Tenants Legal Liability

This is coverage for damages that may be caused to a rented venue where your event is taking place during the rental period.

Special Event Coverage

Get protection specifically designed for your event type, duration, and limits that you select depending on venue requirements.

How It Works

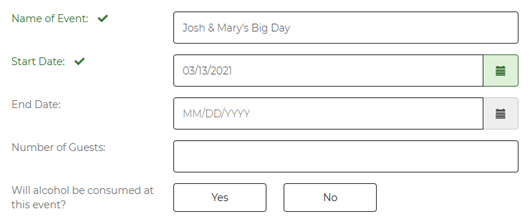

Provide some basic information about your event.

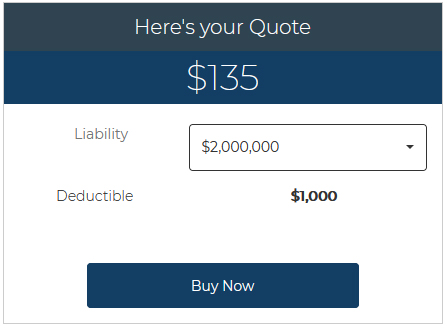

Get an instant quote for your event liability policy online.

Enjoy your event knowing you're covered!

Learn more about Event Liability Insurance

What's covered by Event Insurance?

Event Insurance offers Commercial General Liability coverage from $1,000,000 – $5,000,000 (Third Party Property Damage / Bodily Injury) including Alcohol / Liquor Liability as well as Tenants Legal Liability coverage. Rental venues often request to be named “Additional Insured” on event liability policies and we ensure you have all your bases covered with our events package.

Why do I need Event Insurance?

Lawsuits arising from event claims can be costly – ensure you are protected from costs of defense and potential claim payouts with this coverage. Examples of events include weddings, birthday parties, music festivals, film festivals, concerts, family reunions, film shoots, theatrical performances, craft shows, and more. Event venues frequently require event liability insurance to be in place to set foot on the premises at all as an event host.

How much does Event Insurance cost?

The cost of an event policy will depend on event specific details including the type of event, number of people attending, if alcohol is being served, and the limit of liability required. We are able to offer premiums as low as $75 for this coverage.

Don’t worry, completing our online application for insurance does not cost anything or require you to proceed with the coverage once a quote is provided – customer service is our first priority.

What kinds of events can be covered?

We provide coverage for a wide variety of events, including but not limited to:

- Weddings, Ceremonies & Receptions

- Birthday Parties

- Celebrations of Life

- Christmas & Holiday Parties

- Dry Grad Events

- Concerts

- Theatre Performances

- New Year Celebrations

- Reunions

- E-Sports & Gaming Tournaments

- and more…

What is the event eligibility criteria?

Confirm that you have read and understand the following restrictions and limitations:

- Alcohol must be served by a qualified server (“Serving It Right” licensed)

- Exclusion for fireworks & pyrotechnics

- Excludes injury to entertainers & performers

- Coverage is limited to the designated premises

Related Articles

Hosting an Event? Here’s why you should purchase Event Liability Insurance

The big day is approaching! Whether it be your special wedding day with all of your friends and family attending, or a 30th birthday bash for the ages; you envision

What Is Wedding Insurance and What Does It Cover?

You’ve booked the venue and fine-tuned the guest list. You’ve hired a DJ and tasted the cake. One more thing to consider adding to your “I do” checklist? Invest in

Our Underwriters

What Our Clients Say