Cyber Liability Insurance

(Digital Data Breach Liability Coverage)

Today’s business environment comes with unique risks that are truly a sign of the times. Ensure you and your business are covered from digital exposures with Cyber Liability Insurance (also called Cyber Security Liability Insurance). Protect you from potential digital vulnerabilities and their liabilities while handling sensitive client data, including fraud response expenses, and more.

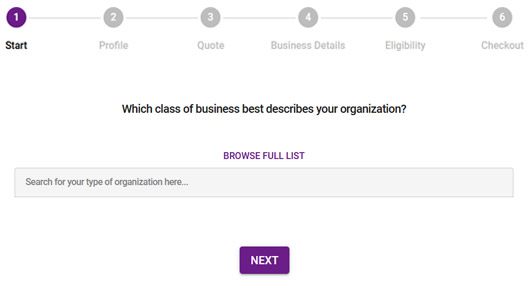

- Instant online quotes

- Electronic policy documents

- Reliable underwriters

- Same day coverage

- Automated renewal reminders

- Coverage for the digital world

Forensic and Legal Expenses

Getting to the bottom of a data breach or hacking occurrence can be time consuming as well as very expensive. Ensure you and your business are covered with this policy.

Fraud Response Expenses

Whether you operate a small, medium, or large corporation, fraud is something that all businesses are susceptible to. Fraud response coverage will protect you from these exposures.

Enterprise Security Events

Keeping you and your clients' data secure is expected by all parties doing business today. Don't get caught without an adequate insurance policy in place.

Extortion Loss Coverage

Cyber-criminals and data hackers are just a few examples of how your business could be left with an extortion exposure. Loss and protection coverage are included with cyber liability.

How It Works

Provide some general information about your business & exposure.

Receive an instant quote with an option to purchase coverage online.

Rest easy knowing that your company has reliable cyber insurance coverage.

Learn more about Cyber Liability Coverage

What is Cyber Liability Insurance and what does it cover?

Cyber Liability Insurance coverage is an important form of protection to have for any modern business that uses electronic devices and information within the company and / or handles client data in a digital manner. This includes financial statements, payment methods, ownership information, and any other sensitive data that could cause a company damages should it get into the wrong hands.

When you consider how much of most businesses daily operations occur in the digital world, in a cloud, or even on private servers; there are certainly a variety of exposures to consider that could cause harm to your company, or one of your clients. Here are some key considerations to take into account that a Cyber Liability Insurance policy will cover:

General Cyber Coverage

- With Minimal Deductible / Retention ($1,000)

Third Party Liability Coverages

- Aggregate Claims Made Liability Coverages

- Each Enterprise Security Event Claim

- Each Privacy Regulation Claim

First Party Coverages

- Aggregate First Party Coverage

- Crisis Management Expense

- Fraud Response Expense

- Public Relations Expense

- Forensic and Legal Expense

- Extortion Loss Protection

There’s certainly a lot to know in about the cyber space these days, so don’t hesitate to contact us if you’d like to discuss any policy specifics.

Why do I need Cyber Liability Insurance coverage?

The business landscape has changed drastically over the past few decades. Technology and computers have become the norm for all kinds of companies and their operating models. With this change has become new and unique exposures that your traditional insurance policy has yet to take into account. A Cyber Security Liability Insurance policy will protect your business from claims that could arise as a result of hackers or other form of data breach with electronic information.

Not only can claims in this field be quite costly, but if you’re left unprotected, it can ruin your company reputation as well as leave you with a nasty legal bill or court ordered payout. Cover legal expenses and any other potential digital exposures with a cyber liability policy.

What types of businesses can be insured?

We can offer Cyber Liability Insurance policies for numerous types of businesses. You can obtain an instant online quote for the following types of operations, but custom coverage can be provided should you not fit into these categories:

- Agriculture, forestry, fishing, hunting

- Construction

- Manufacturing

- Wholesale Trade

- Trucking Services / Transportation

- Information Technology (IT)

- Real Estate

- Property Managers, Rental & Leasing

- Professional, Scientific, and Technical Services

- Administration and Support Services

- Waste Management Services

- Arts (Film & Media)

- Accountants

- Architect & Engineers

- Lawyers

- and more

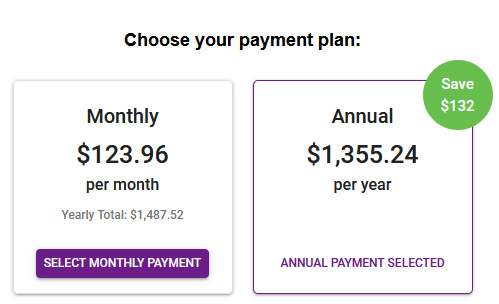

How much does Cyber Liability Insurance cost?

The cost of privacy liability insurance / cyber security liability insurance depends on certain variables that are directly related to your business and the type of exposure. Cost can be determined by, but not limited to, the following:

- Type of industry you’re in

- Limits of coverage you’d like

- Annual revenues and exposures of your business

- and more

Not to worry, completing our online application doesn’t cost anything or hold you to proceeding with coverage once a quote is provided. Customer service and client education is our first priority. Get a quote in just a few minutes today!

Examples of Cyber Liability Claims & Exposures

Our Underwriters

What Our Clients Say