Off-Road Vehicle Insurance

Get a free quote in just minutes online with our Off-Road Vehicle Insurance package. No need to travel to your local insurance shop to fill out paper work, sign documents, or provide payment. Get the coverage you need for your ORV directly in the web browser today.

- Instant online quotes

- Electronic policy documents

- Select the coverage that matters to you

- Automated renewal reminders

- Reliable underwriters

- Next day coverage

Personal Riding Liability

You care about your vehicle and want to ensure that its protected; however, your liability while riding the vehicle is just as important. This is included in our ORV Insurance product.

"All Risk" Physical Damage

The vehicle that you use in your leisure is a valued asset. Cover physical damage or loss to your offroad vehicle at great rates. Include your VIN number while binding.

Your Riding Gear

Any of the gear that you utilize while riding your vehicle can also be covered through this policy. If you don't want to include your riding gear or it's insured elsewhere, no problem!

Trailer or Truck Deck

The trailer or deck you tow your ORV with can be included. Should you store your vehicle at a vacation getaway and don't need this coverage, no worries - you don't pay for it!

How It Works

Provide some basic info about your off road vehicle.

Get an instant ORV insurance quote & purchase online.

Head out on the trails knowing your vehicle is covered!

Learn more about Off-Road Vehicle (ORV) Insurance

What is Off-Road Vehicle Insurance?

ORV Insurance is peace of mind for your vehicle, riding gear, truck deck / trailer, and even obtain accident & rescue benefits with our custom package built for Canadian off road enthusiasts. Select the coverage that is important to you and remove extras so you only pay for the protection you’re looking for.

Why do I need to cover my ORV?

Off-Road Vehicles Insurance is designed to cover not only your riding liability, but any damage to your vehicle and even the trailer or truck deck used for towing it. You enjoy time out on the trails with your ORV; ensure you have adequate protection should anything unexpected happen while riding or storing your pride and joy.

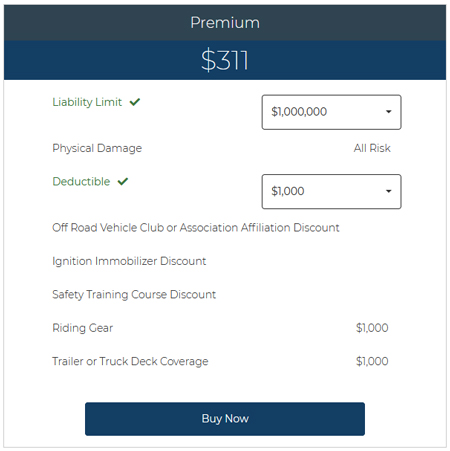

How much does Off-Road Vehicle Insurance cost?

The insurance policy for your ORV will vary in cost depending on the following specifics:

- Value of the vehicle

- ORV specifics & upgrades

- Any excess property coverage you’re looking for

- Years with a driver’s license and suspension history

- Claims history

- Traffic violation history

- and more

Get started on your free quote online today and get insured in just a few minutes.

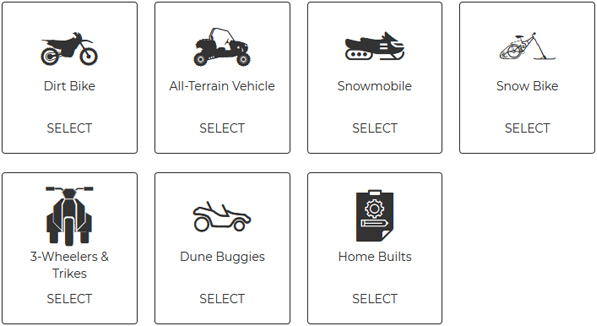

What kinds of vehicles can be insured?

We provide coverage for various types of ORVs including:

- ATVs

- Dirt Bikes

- Dune Buggys

- Snowmobiles

- Snow Bikes

- Trikes

- and Custom Builds

Eligibility Criteria

The operator must meet these requirements in order to purchase coverage:

– Driver’s Licence has NOT BEEN CANCELLED or SUSPENDED in the last 5 years

– Insurance Coverage has NOT BEEN CANCELLED by an insurer for reasons OTHER than non-payment.

– Has NO MORE than 3 traffic violations in the last 5 years.

The vehicle must meet these requirements in order to continue:

– The vehicle is NOT USED FOR RACING or COMPETITION

– The vehicle is NOT USED FOR BUSINESS PURPOSES

– The vehicle is NOT LEASED or RENTED TO OTHERS

– The subject risk is NOT located within 50 KMs of an active wildfire.

In the off season the vehicle is required to be stored inside an enclosed garage, storage locker, or inside a carport / parkade – chained and secured.

Types of Off-Road Vehicle Coverage Available

Snowmobile

Snow Bike

Snow Bike Insurance

Get a QuoteTrike (3 Wheeler)

Trike (3 Wheeler) Insurance

Get a QuoteOur Underwriters

What Our Clients Say