Wedding Insurance

The most important day of your lives is approaching, you’re marrying the love of your life. Ensure nothing unexpected ruins your special day with a Wedding Insurance policy. Coverage for the things that matter most at your wedding as well as the days and weeks leading up to it.

- Cancellation Expenses

- Rings, Cake & Flowers

- Wedding Gifts

- Honeymoon Cancellation

- Loss or Damage to Bridal Attire

- Venue Liability

- Liquor / Alcohol Liability

Rings & Wedding Gifts

Physical loss or damage to items including: rings, wedding presents, cakes, flowers, bridal attire, and more can be included in your wedding insurance package.

Cancellation Coverage

Reimbursement / recovery of any deposits paid or contracts committed to because of unexpected wedding cancellation are insured so you can rest easy.

General Liability

Commercial General Liability (CGL) covers the partners to wed from third party property damage (PD) or bodily injury (BI) claims that could arise during a wedding reception or ceremony.

Liquor Liability

If there's alcohol being served at your wedding reception, we can provide Host Liquor Liability which extends to the venue when they're added as an 'Additional Insured' (included free of charge).

If you'd only like Wedding Liability Insurance

How It Works

Provide some basic info about your your wedding ceremony & reception.

Review your quote and decide if you'd like to proceed with coverage.

Enjoy the most amazing day of your life knowing that you're covered.

Learn more about Wedding Insurance

What's covered by Wedding Insurance?

There are various forms of coverage included as part of our Wedding Insurance package. Have a look through the list below which outlines each form of insurance and what it covers:

1. Commercial General Liability

This is liability for 3rd party property damage or bodily injury that could occur at one of your wedding events including rehearsal dinner, ceremony, reception, and gift opening.

2. Host Liquor Liability

As long as a “Serving-It-Right” licensed bartender is serving the alcohol at your engagement party / wedding reception, you’re covered for potential liability claims involving liquor consumption.

3. Wedding Cancellation

The cost to reserve your venue including any deposits or amounts owed under contract can be paid via your wedding insurance policy.

4. Honeymoon Cancellation

This policy will reimburse the Insured if there is a loss of pre-paid, non-refundable costs of travel due to the cancellation of the actual wedding.

5. Loss of Deposits

Our reliable Underwriters will pay for non-refundable deposits that had been paid to providers of any booked goods or services if they suffer financial failure.

6. Wedding Photos & Videos

Any extra expenses that may be necessary to retake the photos and videos that cannot be reproduced from your wedding day for any reason including non-appearance of photographer.

7. Bridal Attire

Coverage for physical loss or damages to your bridal attire once the item is in the care / custody of the Insured. We know how expensive wedding dresses can be!

8. Wedding Gifts

Insurance for the direct physical damage or total loss to wedding presents (24 hours prior to and after the wedding ceremony) while the items are at the newly weds’ reception, home, or in transit between the two.

9. Rings / Wedding Bands

Protection from the potential physical loss or damage to rings / wedding bands so you can stop checking if it’s still there. Coverage begins 7 days prior to the wedding.

10. Wedding Cake & Flowers

Direct physical damage and / or loss to the wedding cake or flowers for up to 7 days prior to your wedding ceremony.

11. Wedding Stationery

Any stationery items such as invitations, RSVP cards, menus, name tags, etc. are covered from physical loss or damage.

12. Rented Property & Equipment

Reimbursement for the direct and physical damage to rented items used during the wedding reception are insured! This includes, but is not limited to, temporary outdoor shelters, tents, marquees, tables, chairs, stages, speakers, and other audio / visual equipment.

Can I do a Wedding Insurance comparison?

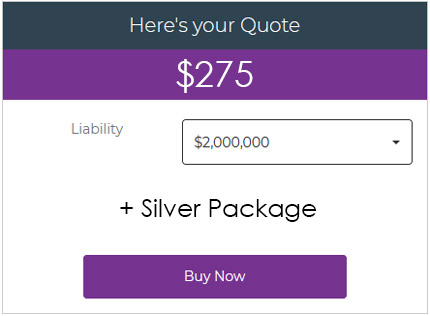

There are multiple package options for wedding insurance protection that have varying limits of coverage. Here’s an overview of the policy limits available:

Silver Package (starting at $250)

- Up to $4,000 for cancellation expenses

- Up to $2,000 for honeymoon cancellation

- Up to $2,000 for loss of deposit

- Up to $2,500 for wedding photographs and video

- Up to $2,500 for loss or damage to Bridal Attire

- Up to $5,000 for wedding presents

- Up to $1,000 for Rings

- Up to $2,000 for Cake and Flowers

- Up to $1,000 for Wedding stationary

- Up to $1,000 for Rented property

Gold Package (starting at $350)

- Up to $10,000 for cancellation expenses

- Up to $2,500 for honeymoon cancellation

- Up to $3,000 for loss of deposit

- Up to $5,000 for wedding photographs and video

- Up to $2,500 for loss or damage to Bridal Attire

- Up to $5,000 for wedding presents

- Up to $1,500 for Rings

- Up to $2,500 for Cake and Flowers

- Up to $1,500 for Wedding stationary

- Up to $10,000 for Rented property

Diamond Package (starting at $600)

- Up to $30,000 for cancellation expenses

- Up to $5,000 for honeymoon cancellation

- Up to $5,000 for loss of deposit

- Up to $7,000 for wedding photographs and video

- Up to $5,000 for loss or damage to Bridal Attire

- Up to $7,000 for wedding presents

- Up to $3,000 for Rings

- Up to $5,000 for Cake and Flowers

- Up to $3,000 for Wedding stationary

- Up to $15,000 for Rented property

Platinum Package (starting at $900)

- Up to $50,000 for cancellation expenses

- Up to $5,000 for honeymoon cancellation

- Up to $6,000 for loss of deposit

- Up to $7,500 for wedding photographs and video

- Up to $7,000 for loss or damage to Bridal Attire

- Up to $8,000 for wedding presents

- Up to $5,000 for Rings

- Up to $6,000 for Cake and Flowers

- Up to $4,000 for Wedding stationary

- Up to $20,000 for Rented property

Liability limits (for Commercial General Liability (CGL) & Host Liquor Liability) can be $1 million, $2 million, or $5 million. If you’d like to get a quote for wedding liability insurance only click here.

Please note, all Wedding Insurance purchases are final and the premium is not eligible for refund. We reserve the right to charge a small fee (<$100) for any policy changes required.

Why should I purchase a Wedding Insurance policy?

You and your significant others’ wedding day is one of the most special days of your entire lives! Don’t risk having something that is outside of your control ruin not only the engagement party, wedding, or reception, but all of the memories that could also be effected. Complete our brief, online application form and get a quote to rest easy knowing your big day is insured.

You can learn more about a wedding package policy in our blog post “What is Wedding Insurance and What Does It Cover?“.

How much does Wedding Insurance cost?

The cost of a wedding insurance policy will depend on the type of coverage you are looking for as well as the protection limits you desire. Our package prices range from $250 up to $1,000+.

Not to worry, completing our online application for insurance doesn’t cost anything or commit you to proceeding with coverage. Customer service is our first priority.

Is this the best Wedding Insurance available?

Yes! Well… Of course that’s our opinion. We offer insurance backed by Lloyds of London cover holders, PAL Canada. It is a great package with reliable claims service through our insurance partners. We encourage you to shop around online and decide for yourself. Netsurance is confident that you’ll end up going with one of our product options.

Related Articles

What Is Wedding Insurance and What Does It Cover?

You’ve booked the venue and fine-tuned the guest list. You’ve hired a DJ and tasted the cake. One more thing to consider adding to your “I do” checklist? Invest in

Hosting an Event? Here’s why you should purchase Event Liability Insurance

The big day is approaching! Whether it be your special wedding day with all of your friends and family attending, or a 30th birthday bash for the ages; you envision

Our Underwriters

What Our Clients Say