Electrician Insurance

Custom Coverage for Electrical Contractors

Ensure you and your business are covered with with our custom Electrician Insurance package. Cover the things that matter to your business such as your commercial liability and your tools / equipment. This is part of our Contractors Insurance program that offers customized coverage by business class. Get started today!

- Instant online quotes

- Electronic policy documents

- Select the coverage that matters to you

- Automated renewal reminders

- Reliable underwriters

- Next day coverage

Commercial General Liability (CGL)

Commercial General Liability for your business operations in the event you are held liable for third party property damage or bodily injury.

Tools & Equipment Coverage

Property insurance for your business tools, equipment, office contents, and even stock. You can include items like power tools, wiring, and computers.

Electrician Specific Insurance

We are also able to provide any unique coverage relevant to your business specifically such as Professional Liability if you do design work, etc.

Free Instant Online Quotes

Our electricians insurance package available through the contractor's application enables you to get insured in minutes and focus on what's important - your business!

How It Works

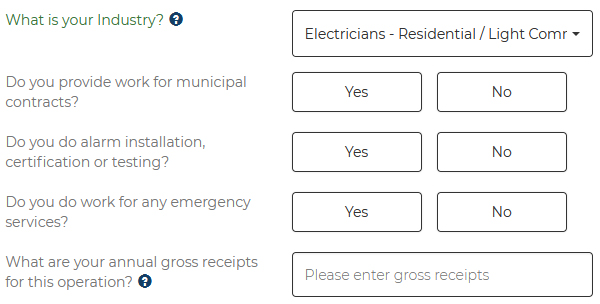

Complete our online application with some details about your business.

Review your quote and select the coverage that's best for you.

Be the best "sparkie" you can be knowing you're covered by a reliable insurance policy!

Learn more about Electrician Insurance

What's included in Electrician Insurance?

We will review your application and determine what coverages are best for your electrical operations. However, there are some coverages, such as Commercial General Liability (CGL), that are essential for your electrical contracting business. We will ensure you and your company are protected against liability claims for bodily injury (BI) and property damage (PD) arising out of premises, operations, products, and completed operations.

Standard limits for a CGL policy range from $1,000,000 to $5,000,000 depending on your requirements. We also offer coverage for your tools and equipment. Depending on your operations, it may also be relevant to look into a Professional Liability (E&O) policy if you are doing any design work or programming electronic controllers, etc.

You can also include insurance for your tools, equipment, stock, and office contents. This is sometimes called Commercial Property (Business Property) and can include items such as:

- Company Tool Sets

- Wire Strippers & Cutters

- Electric Drills

- Wiring (Copper, etc.)

- Any other materials you may keep in stock

- And more…

Why do I need Electrician Insurance?

It’s important to cover your tools and equipment that can be worth thousands (or even ten’s of thousands) of dollars, but damages arising from liability claims can be significantly more costly. We’ll arrange a policy that shields you and your company from not only bodily injury and property damage claims, but the expenses of out-of-court settlements, litigation, and judgments awarded by the courts as well.

If damages are filed against your organization or you are sued, our reliable insurers will cover the costs for investigation, attorney expenses, and medical expenses in the case of injury.

Operations that can be included in your liability coverage include:

- Residential Service and Maintenance

- Commercial Service and Maintenance

- General Electrical Distribution

- Wiring for New Builds

- Wiring and Installs for Renovations

- Tenants Improvements

- and more…

Not only are you insuring your liability with this insurance package, but often times project owners (such as general contractors, school boards, or municipalities) will require to be named “Additional Insured’s” on your policy to be able to do work for them. This option is provided at no additional cost on your policy. If you’d like to check out our blog post on “How to get your Electrical Contractor License in BC” (may also be relevant to other provinces) you may do so here. It provides some good insights to starting a business if your electrical contracting company is a new venture.

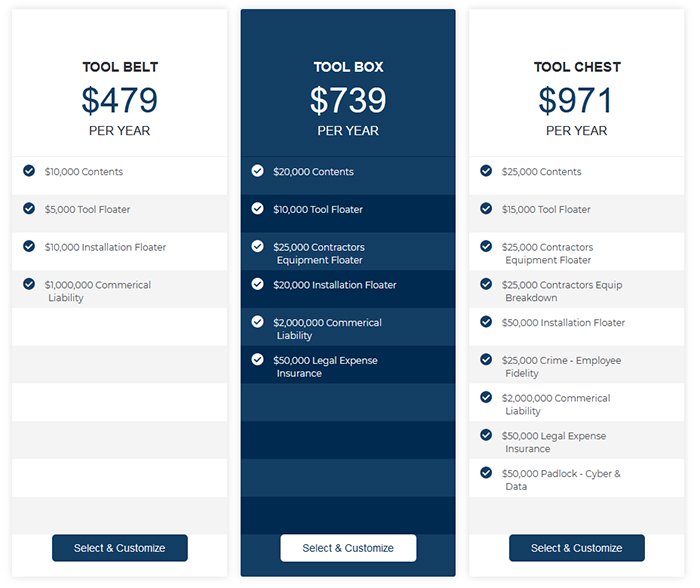

How much does Electrician Insurance cost?

The cost of your electrician insurance policy will depend on application variables which include what your operations will be, annual revenues, number of employees, deductibles, specified coverages, and the limit of liability requested. We are able to offer insurance terms with premiums as low as $600 for annual coverage.

Please note that completing our application for insurance does not cost anything or require you to proceed with the coverage once a quote is provided – customer service is our first priority.

Our Underwriters

What Our Clients Say