RMT Insurance

Get an instant online quote for your RMT Insurance package so you can focus on what’s important, giving your clients an amazing massage experience. Select the coverage that works for your business with our customized Registered Massage Therapist Insurance. We can also facilitate coverage for non-RMT massage therapists – click here to get started.

- Instant quotes online

- Same day coverage

- Electronic policy documents

- Automated renewal reminders

- Reliable underwriters

- Competitive pricing

- Monthly payment option

Professional Liability (E&O)

This is the primary form of coverage relevant to RMTs. Also called Errors & Omissions Insurance, it covers your massage operations should a client claim you caused them personal harm.

Commercial General Liability (CGL)

CGL Insurance is another important type of coverage for masseuses. It provides coverage for 3rd party property damage or bodily injury not directly related to your massage operations.

Business Contents & Equipment

Your property you use in the course of business can also be insured. This includes coverage for items such as massage tables, computers / laptops, and more.

Coverage for Massage Therapists

Your business is unique and has specific risks in the massage field. Ensure you have a policy that's custom built for your industry and keep your mind on what's important, your clients.

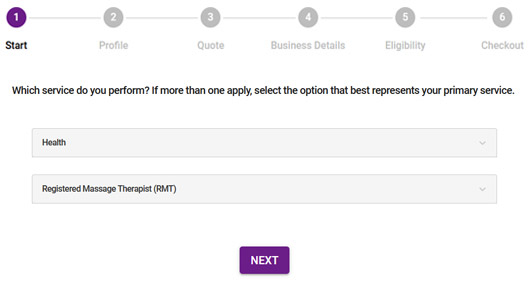

How It Works

Provide some general information about your massage operations.

Receive an instant quote with an option to buy coverage online.

Be the best RMT you can knowing that you have adequate insurance.

Learn more about RMT Insurance

What's covered by RMT Insurance?

Insurance for Registered Massage Therapists doesn’t have to be complicated. There are a few types of coverage that are essential for RMTs and we’ve provided an outline for you below:

Professional Liability or Errors & Omissions Insurance (E&O)

This is the portion of your insurance that protects your massage operations. You’ve trained tediously to ensure you understand the human body and how to massage your patients; however, there’s always the potential for a mistake or an unhappy client. E&O coverage covers any potential liability claims that could arise while you’re massaging. This includes coverage for court, defense, and litigation costs should you be sued or have a legally instructed payout.

Commercial General Liability Insurance (CGL)

CGL Insurance is also an important aspect of your massage therapist policy. This will ensure that if there are any bodily injury (BI) or property damage (PD) claims that are not a direct result of your masseuse operations, you’re covered. This can include incidents such as slips & falls at your premises, or if you damage somebody else property by mistake.

Business Contents & Equipment (Property Coverage)

The items you use during your course of business make the cogs turn and everything run smoothly. You can choose to insure any contents or equipment you use as part of your RMT work. This can include things like your massage tables, computers, and other items you deem important.

Why do I need insurance as a Registered Massage Therapist?

Purchasing insurance as an RMT is as important, if not more important, than any other business. An unexpected claim can leave you in a dire financial position not only as a company, but personally as well. Bodily injury claims and other liabilities can be covered by an RMT Insurance policy and can make all the difference in the event the unthinkable happens. Customize your policy with limits and types of coverage that you feel is important with our easy-to-use online application. Get insured in just minutes!

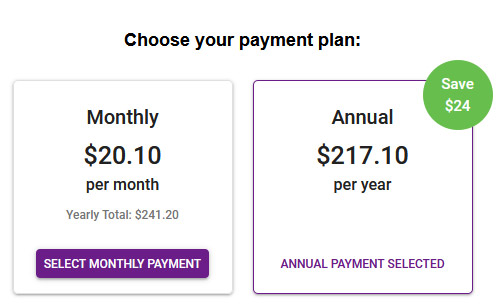

How much does RMT Insurance cost?

The cost of your Registered Massage Therapist Insurance policy will depend on certain variables that determine the total risk of your operations. These variables include things such as:

- Specifics of services provided

- Limits of coverage you’d like

- Deductible amounts

- Revenues derived from your operations

- and more

We’re able to offer RMT Insurance for as low as $20 per month, so get started on our brief, online application today to get a quote.

Don’t worry, completing our online application for insurance does not cost anything or require you to proceed with the coverage once a quote is provided. Customer service and client education is our first priority.

Our Underwriters

What Our Clients Say