Food Truck Insurance

Ensure you and your business are covered with our customized Food Truck Insurance policy. Cover the things that matter to your business like commercial liability and your cooking equipment. Click ‘Get a Quote‘ today to complete our online application and let us do the quote shopping for you.

- Online quotes to your e-mail

- Electronic policy documents

- Reliable coverage providers

- Custom mobile food truck insurance

Commercial Liability

Commercial General Liability (CGL) for your business operations in the event you are held liable for third party property damage or bodily injury.

Your Food Truck

Depending on which province you'll be operating in, you may obtain coverage for your food truck, cart, or trailer itself; as well as your liability while driving it.

Cooking Equipment

Property coverage for your cooking and food / drink production equipment such as blenders, deep fryers, stoves, generators, slow cookers, and more.

More Coverage Available

We are also able to provide any unique coverage that may be relevant to your business such as food & stock, business interruption, and more.

How It Works

Complete our customized online food truck insurance application.

Receive your quote via e-mail and decide which coverage is right for you.

Serve up the food & drinks you share with customers knowing you're covered.

Learn more about Food Truck Insurance

What's included with Food Truck Insurance?

When it comes to insuring your food truck business, it’s important to ensure you have coverage package that fits your operations. Every business is unique and we know that! There are 2 types of coverage that are essential to food truck, trailer, and cart ventures. They are as follows:

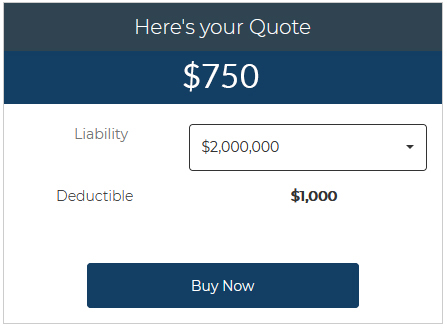

Commercial General Liability (CGL) – provides public liability (PL) including third party property damage (PD) and bodily injury (BI) amongst other coverages such as cross liability, and more. Typicaly limits for a food truck liability insurance policy range from $2,000,000 (as is the minimum requirement of City of Vancouver) to $5,000,000 depending on your preference and risk. Commercial automobile liability, the risk of driving your food truck, is not included in this package and should be purchased for your truck while on the road. Specifics about automobile liability may differ depending on which province you are located in (eg. ICBC in British Columbia).

Business Property (Cooking Equipment, etc.) – Another important aspect of food truck / food cart insurance is the property you use in your business operations (also called commercial property). Your vehicle itself should be covered along with your auto insurance package; however, the equipment you use on a daily basis including generators, cooking appliances, gas tanks, fridges, etc. need coverage as well. Our food truck insurance program enables you to include the equipment you use for your business so you can focus on what’s important, cooking great meals for customers.

Why do I need Food Truck Insurance?

Whether it was at the request of a local municipality, or an online article that made you consider what could happen in the event of a loss; you’ve realized you need insurance for your food truck business. This is a form of risk mitigation and protection planning that is very important for your business.

Damages arising from liability claims can be quite costly. We can arrange a policy that shields you and your company from not only bodily injury and property damage claims, but the expenses of out-of-court settlements, litigation, and judgments awarded by the courts as well. If damages are filed against your organization or you are sued, our eliable insurers will cover the costs for investigation, attorney expenses, and medical expenses in the case of injury.

Theft, fire, and other risks are also losses that can be insured for your cooking equipment and other food truck interior property. Without access to your food production equipment, continuing business operations would be a struggle. Ensure your property is protected with Food Truck Insurance, food trailer insurance, and food cart insurance.

How much does Food Truck Insurance cost?

- Your Overall Operations

- Type of Food & Drink Offered

- Annual Revenues

- Number of Employees

- Specified Coverages & Limits

- Deductibles

- and more

Coverage Regulations Per Province

Depending on which city you’re operating in, or if you’re very mobile and travel between provinces, there are specifics of insurance that must be met depending on where you’ll be selling. For example, in the City of Vancouver, one of the application documents needed for a mobile / roaming food vending permit is a valid liability insurance certificate (you can see a sample of this here). You will receive this confirmation document to provide to any licensing authorities upon purchase of your Food Truck Insurance policy.

Our Underwriters

What Our Clients Say