So, the time has come that your business is in need of Construction Bonds? Well don’t worry, you’ve come to the right place to get the lowdown on what a construction bond is and how you can obtain one – or many bonds, depending on your requirements. If you feel you’re well informed enough on what a bond is and just want to begin the application process, visit our bonding page and get started on a Surety Bond Facility. If you’d like to learn more about construction contract bonds then keep on reading for an overview of surety in the construction space.

What is a Construction Bond?

Let’s start with the basics, what is a construction bond anyways? We should start with defining a surety bond in general…

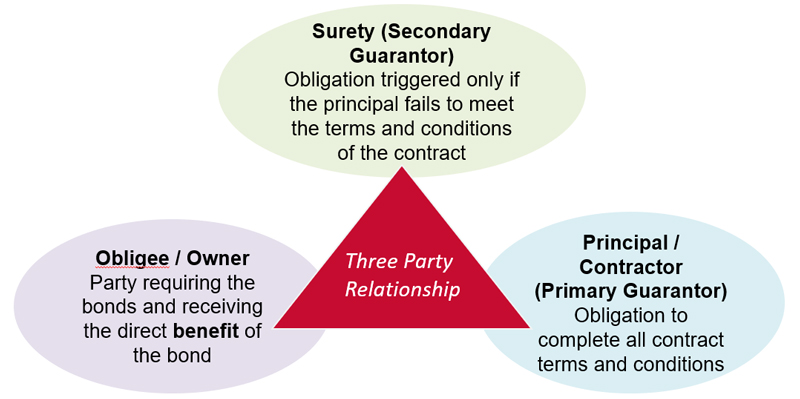

Surety Bond: a three (3) party security agreement that protects the obligee against losses resulting from the principal’s failure to meet an obligation.

Phewf! That was a bit of a mouthful, but no need for concern. Below is a diagram that may make things a little more clear for you.

This three party aspect is one of the major differences between surety bonds and insurance (insurance is a two party instrument). Another important point to note is that insurance policies expect losses, whereas bonds do not and are protected by what is called an Indemnity Agreement. This means that the Principal (you) is responsible for any claims that would be paid out to an obligee, even though the damages are first paid by the surety company.

Is your head spinning yet? That’s okay. We’ll start applying examples in the construction space so you can better comprehend how construction bonds are applicable to you and what they mean for your business and operations.

Bottom line is, a construction bond lets a project owner (obligee) know that you are a reputable business and an insurance / surety company is willing to back your operations in the form of a surety bond. Think of the ability to provide bonds as a subscription that you maintain with a guarantor in order to be qualified for projects that required specific expertise. We call this subscription a “Bond Facility” – the constant ability to provide contract bonds.

Different Types of Construction Bonds

Now that you have a better idea of what a construction bond is, we’ll delve into the different kinds of surety bond instruments that are available for construction contractors. These can be split into a few different categories. Bonds that are applicable during the tender phase and bonds that apply to a contract phase (once a project has been awarded).

Tender Phase Construction Bonds

Bid Bond: a bid bond is a financial instrument that is used as a proof of commitment for a contractor to submit a tender price for a specified project. These are typically provided in the amount of ten percent (10%), but can also be a specified dollar amount ($) or other percentage.

Consent of Surety / Agreement to Bond: a consent of surety (also called surety’s consent or agreement to bond) is often provided in conjunction with a bid bond in order to commit to other types of bonds that will be issued should a contractor be successful on a tender. We’ll discuss common final bond requirements more below.

Sunshine / Good-Guy Letter: a “sunshine letter” is a more informal notification that a contractor has the capabilities to provide bonding. It’s sometimes used in the RFP stage for owners to gauge the interest and capacity of construction contractors that are willing to bid on a job.

Contract Phase Construction Bonds (also called Final Bonds)

Performance Bond: a performance bond is a surety instrument that guarantees the performance of construction works outlined in a contract that has been awarded to a contractor. These bonds are conventionally in the amount of fifty percent (50%), but can be up to 100% of the contract price.

Labour & Material Payment Bond: a labour and material payment bond (or L&M bond) is a document that provides security for the principal contractor’s sub-contractors and suppliers in the event the principal is unable to pay them. Again, we often see 50% of contract value requirements, but can be issued for up to 100%.

Maintenance Bond: a maintenance bond is a specific bond wording that is used to guarantee the maintenance of a specified contract works for faulty workmanship and / or defective materials after substantial completion and acceptance of the performed work. To clarify, maintenance bonds are issued once a project is complete for a longer guarantee. These can be provided for painting, piping, and other types of works.

Other Types of Contract Bonds: depending on the specific owner / obligee / municipality work is being performed for, there may be other construction bond requirements that are set forth by project owners. If you have a different inquiry than what we have listed, don’t hesitate to contact us. You can also learn more about standardized Canadian construction bond wordings through CCDC’s website (Canadian Construction Documents Committee).

We recognize that the information above is a decent amount to digest and there are various industry specific terms that are used. At the end of this article we have a “Surety Bond Terminology You Should Know” section which can be very helpful for staying on track.

How much do Construction Bonds cost?

Now that you have an overview and understanding of what construction contract bonds are, let’s get you an idea of how much they’ll cost to have in place. This can depend on a variety of factors including what we refer to as the three C’s of surety. These are Character, Capacity, and Capital. Basically, the business owners history in the construction industry, personnel available to perform work, and finances available to backstop the company.

These aspects of a business along with other contributing factors will all play a role in determining the cost of bonding. In general, a contractor should have $1,500 – $3,000 CDN reserved for the Bond Facility fee that is required to have a contractor setup for the ability to provide bonds for the first time. A Bond Facility is then charged for on an annual basis to maintain the ability to obtain bonding.

After that, the tender phase bonds (bid bond, consent of surety, etc.) do not cost anything; however, final bonds (performance, L&M, and maintenance bonds) will be based on a rate per $1,000 of specified contract price. A standardized industry rate for 50/50 bond security is in the range of $10 / $1,000. This is approximately 1% of a contract price. For example, if you have a project with a value of $1,000,000 that needs to be bonded – the 50/50 bonds required will cost $10,000 premium.

Bonding rates can vary greatly and your businesses specific financial situation as well as history in the construction space will effect price. We’ve seen bonding rates as high as $25 / $1,000 and as low as $2 / $1,000. These extremely low premium rates are reserved for large scale construction contractors that have tens of millions of dollars in assets that are provided as effective collateral on an Indemnity Agreement.

(Annual Fee)

(Facility Required)

(Varying Rate)

Bond Facility Setup & Indemnity Agreement

To get your business the ability to provide bonds, we mentioned that you’ll need to setup what we call a Bond Facility. These are specifics about what size and type of work you can bond for your construction business. A Bond Facility setup will review the following information and maybe some other specifics depending what area of construction you are in:

- Contractors Questionnaire (outline / resume for your business)

- Accountant prepared Financial Statements for past 2 year-ends

- Personal Net-Worth Statement for each shareholder in the business

- Work On Hand Reporting (how much outstanding work you have on the go – uncompleted)

- Financial Statements for any affiliated or alternate business pursuits of the shareholders

Once the information above has been provided for your business, we’ll provide you with what is called an Indemnity Agreement. The indemnity is signed by the shareholders of a construction company to ensure that a surety / insurance company will be able to recover funds that may need to be paid out to obligees in the event of a claim on a bonded job. This means that the bonded contractor (principal) is responsible for not only remedying any issues that may arise on a bonded project, but funding damages that could be caused as a result of their “default” (default is described further in our terminology section below).

Important: Depending on how much capital is available in your business, personal and even spousal indemnities may be required in order to provide bonding capabilities for your construction company.

Kinds of Construction Projects That Need Bonding

Construction bonding is often a requirement of owners for many different types of projects. Ultimately, the need for bonds will be left up to the owner of the job and the level of security they feel comfortable allocating to the works being performed. Construction bonds may be required on both public / municipal contracts, as well as private projects and builds. Some examples of projects that are often bonded include, but are not limited to the following:

- Road Building

- Bridge Building

- Street Lighting Contracts

- Site Servicing for Mechanical and Electrical works

- Hospitals

- Prisons

- Commercial & Residential Developments

- Road Maintenance

- Much more…

Get Started on a Bond Facility for your business!

Well, that’s our crash course on Construction Bonds – Contract Surety 101. We hope that you learned a lot and now feel more comfortable when approaching a bonded project and what steps should be taken if your business is eligible for bonding. We invite you to get in touch with us to discuss next steps for putting together your Bond Facility. Visit our bonding page and select which kind of bond you’re looking for to begin the process.

Thanks for sticking with us and happy tendering!

Surety Bond Terminology You Should Know

Principal: this is you / your business as the construction contractor providing a bond. The principal is the primary guarantor on bonded / security obligations to complete all contracts in accordance with their terms & conditions.

Obligee: the owner / party requiring the bonds from the contractor. This is the party that receives the direct benefit of a bond being issued in the event of a contractor default.

Surety: this is the insurance company that is providing the financial backing and security of a surety bond. They have the liquidity and means to provide guarantees to obligees on behalf of a principal. This term is also used to refer to the bonding industry and bonds in general.

Indemnity Agreement: the indemnity is the documentation that is signed by the principal that guarantees the prinicipals assets to the surety in the event they must payout an obligee due to a principal default.

Default: this is the term used when a principal (contractor) is in violation of the terms & conditions of a contract with an obligee. This can include running out of funds to complete a project, having lack of expertise resulting in poor performance, failure to pay subs, and more.

Bond: the ‘piece de resistance’, a surety bond is a three party financial agreement that provides a guarantee amongst the entities involved in contract.

Seal: the company seal is typically embossed, or embedded electronically onto a bond as a means of authentication along with a surety and / or principal signature on a bond document.

Bond Facility: think of the bond facility as an arrangement between you and the surety company which declares the amount and types of bonds available once you have been approved for bonding.

Security: this can refer to the backing signed over to a surety on an Indemnity Agreement as well as a bond document itself. Essentially, a security is used interchangeably with a guarantee.