Tutor Insurance

Your tutoring business deserves coverage tailored for its specific risks. Get an instant quote online for Tutor Insurance in minutes. Customize a policy that works for you with options for Professional Liability (E&O), Commercial General Liability (CGL), as well as property coverage for computers, etc.

- Instant online quotes

- Electronic policy documents

- Select the coverage that matters to you

- Automated renewal reminders

- Reliable underwriters

- Next day coverage

Professional Liability (E&O)

Also called Errors & Omissions, this form of coverage is the most important for an educational tutor. You can choose limits and deductibles!

Commercial General Liability (CGL)

If you have a premises or office space that you utilize for teaching, it's important to include Commercial General Liability as part of your policy.

Business Contents & Equipment

You can also select limits of property coverage for any equipment you may use as part of your teaching operations. Don't need that? No problem!

Coverage for Educational Tutors

This policy is customized for tutors just like you! Ensure you and your business have adequate coverage for your professional tutoring services.

How It Works

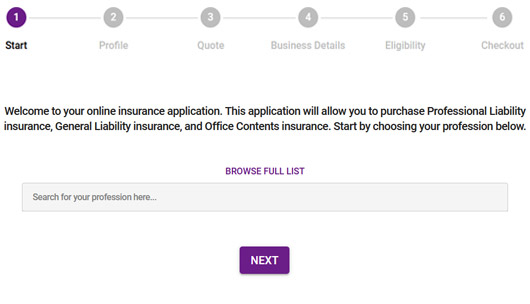

Provide some general information about your tutoring business.

Receive an instant quote with an option to purchase coverage online.

Get back to educating your students knowing you're covered.

Learn more about Tutor Insurance

What is Tutor Insurance?

Our tutor insurance enables you to cover both your liability as well as the property (computers, etc.) related to your business. Allow our online application process to guide you through what coverages can be included for your tutoring operations. There are some forms of coverage, such as Professional Liability (E&O) and Commercial General Liability (CGL), that are great forms of insurance for a tutoring business, but can sometimes be overlooked. Ensure you and your company are protected against liability claims for not only your teachings, but for bodily injury (BI) and property damage (PD) arising out of premises, operations, products, and completed operations.

Standard limits for liability range from $250,000 to $5,000,000 depending on your requirements. You may also select the deductible you’d like for your coverage in the vent of a claim – from $0 (no deductible) up to $25,000.

Why do I need Tutor Insurance?

Like any service-based business, tutoring also comes with its inherent risks. If something goes wrong with a student such as flunking a major exam, legal action may be the pursuit of a parent or guardian. On top of the potential loss to any property you use for your tutoring business, damages arising from liability claims can be quite costly.

We’ll arrange a policy that shields you and your tutoring business from not only bodily injury and property damage claims, but the expenses of out-of-court settlements, litigation, and judgments awarded by the courts as well. If damages are filed against you or your organization; or if you are sued, our reliable insurers will cover the costs for investigation, attorney expenses, and medical expenses in the case of injury.

What is covered by a liability policy for tutors?

When looking at what is covered by insurance for a tutoring business there are specific scenarios that would fall under a few different liability options. Let’s start with the main form of coverage relevant to your tutoring operations, the Errors & Ommissions (E&O) or Professional Liability coverage:

Professional Liability (E&O) – Claim Example

- Let’s say a student of yours is looking to get a perfect score on an upcoming provincial exam to get into a university of their choosing such as UBC or McGill. You provide 6 hours per week of tutoring to go through exercises, review practice exams, and have them ask any possible questions. The student ends up scoring fairly well; however, not well enough to get into their top choice for schools, McGill. You did everything you could, but their parents still end up suing for damages as you failed to have the student achieve their goal. Whether the law is placing you at fault or not, you’re going to court and need a lawyer to defend you in the lawsuit. Your E&O policy will cover costs for your lawyer as well as potential damages awarded.

Another important coverage for your tutoring business could be General Liability for everything from slips and falls, to damaging a student’s property:

Commercial General Liability (CGL) – Claim Example

- A student slipping and hurting themselves on your tutoring premises (third-party bodily injury)

- You accidentally drop your student’s laptop computer and it was an expensive MacBook (third-party property damage)

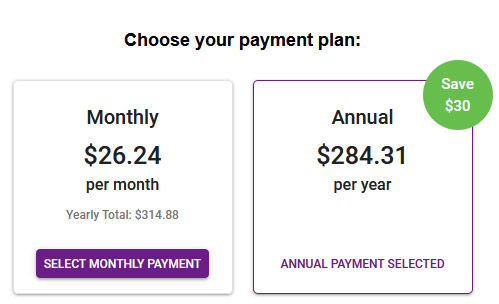

How much does insurance for a tutoring business cost?

The cost of your tutor insurance policy will depend on certain variables that are part of our online application process including annual revenues, specified coverages, and deductibles requested. We are able to offer terms with premiums as low as $300 for annual coverage.

Please note that completing our online application for insurance does not cost anything or require you to proceed with the coverage once a quote is provided – customer service is our first priority.

Our Underwriters

What Our Clients Say