Non-Resident GST Bond

Canada Customs Bond

A Non-Resident GST Bond is a Customs Bond which provides financial security for the governing bodies for imports to Canada. These bonds are issued to Canada Border Services Agency (CBSA) in the amount specified from $5,000 to $500,000+ in value. Whether the bonding requirements are for temporary import or a continuous GST bond, we’re here to help. Apply for your surety bond and even get a free online quote today!

- Online bond application

- Best price nation-wide

- Reliable surety providers

- Automated renewal reminders

- E-bond issuance when available

We Find Ways to say "Yes!"

Many bonding companies will decline anybody that doesn't fit within their limited underwriting parameters. We work with you to find ways to get your bond approved.

Paper Free E-Bonds

Although many bonds still require original hard copies in hand, we eliminate paper where we can and provide digital versions of bonds and surety riders called "e-bonds".

Canadian Guarantees

We use Canada's established surety markets to ensure that the financial guarantees being provided are applicable to Canadian regulations, laws, and standards.

Top Rated Surety Companies

An important aspect of surety bond issuance is the financial rating of the insurer providing the guarantee. We only provide bonds from top rated sureties with proven track records.

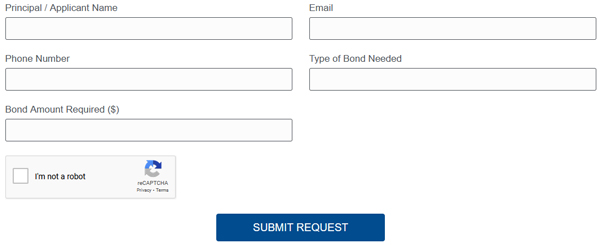

How It Works

Complete our online questionnaire to confirm the bond you require.

We'll be in touch shortly with more information for next steps & a quote.

Get a hard copy of your Non-Resident GST Bond mailed to you (or e-bond if acceptable).

Learn more about Non-Resident GST Bond

What is a Non-Resident GST Bond?

A Non-Resident GST Bond is a 3 party financial instrument that guarantees that a foreign exporter that is importing goods will provide payment for any customs duties and / or taxes on products that are being sent to Canada from a foreign country. It provides security for the governing bodies (like CBSA) that the required duties will be paid even if you (The Principal) fails to do so.

It is important to note that although a customs bond provides coverage from the perspective of the Obligee (Government of Canada), you are still responsible to provide the required / paid funds to the Surety providing the financial backing for any bond issued.

Why do I need a Non-Resident GST Bond?

If you are operating as a customs broker, importer, transportation company, logistic company, or any entity that deals with shipping goods from outside of Canada, it is likely that the Government of Canada requires you to get a Non-Resident GST Bond. The Canada Border Services Agency has a surety bond requirement so there is a financial obligation from a third party to pay any amounts owed up to a maximum of the bond amount should you (The Principal) not comply with the Customs and Transportation Act which is outlined and updated by the Canadian Government.

Is this a continuous Non-Resident GST Bond or is it a one-time instrument?

We can issue both continuous bonds and bonds that are only needed for a one-time or single trip. If you’re unsure if your bond needs to be continuous or not, don’t hesitate to contact us and we can help identify what is required. Typically, only Carnet Bonds can be issued on a ‘one-off’ basis.

How much does a Non-Resident GST Bond cost?

The cost of a Non-Resident GST Bond / Customs Bond can vary depending on the amount required on the bond, duration of the bond, and other applicant specific information. As your surety bond broker, we will always strive to get you the best rate on your requested product. A customs bond can be offered as low as $375 per year, pending the underwriting details outlined above.

Completing our application and pursuing a quote for this bond does not cost anything or require you to proceed with the bond once a quote is provided – customer service is our first priority.

Our Underwriters

What Our Clients Say